Santander Cheque Deposit Uk

Posted : admin On 4/13/2022- Santander Cheque Deposit Uk Casino

- Deposit Cheque In Atm

- Santander Electronic Cheque Deposit Uk

- Santander Cheque Deposit Uk Atm

Santander and Nationwide have stopped accepting cash payments into personal current and savings accounts from people considered to be ‘third parties’ – including anyone not named on the account.

Cheques Santander UK. Insert your card into the cash machine and type your PIN. Choose ‘Deposit cheques’. You’ll be asked to put the cheque/s into the machine. The cash machine will scan the cheques and calculate the value – if there are any it can’t read it’ll. To pay in cheques, you’ll need a pre-printed paying slip and a branded envelope for your cheque deposit. Not all banks are available for these services at the Post Office, and not all the. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Keep in mind there is a $1,000 per day limit and takes 2-3 business days to process. To B of A, that says they cannot accept them. Cheque deposit - up to 30 cheques at a time. Deposit checks with ease; just sign, snap, and go.4. Registered Number 2294747. A lot of people get frustrated here as when you search “Pay in a cheque Santander” on Google you’ll get results from the US arm of the bank. Sadly in the UK there isn’t this feature. Also, for the Post Office option you’ll need to order some paying-in slips and deposit envelopes from Santander in advance.

The move has caused confusion for many, including grandparents trying to deposit gifts into children’s savings accounts and renters making payments to their landlords.

Which? takes a look at why cash is being banned, whether other major high street names accept third-party credits and what to do if you need to deposit money into someone else’s account with these restrictions.

Why banks are banning cash deposits

You might find it bizarre that banks would have a problem with someone paying money into your account – but the move is part of the banks’ larger obligation duty to combat financial crimes, such as money laundering.

This isn’t just paranoid thinking on behalf banks: Cifas reported there were 8,652 cases of young people aged 18-24 being targeted to help move cash as ‘money mules’ between January and September last year.

Nationwide and Santander both say they have introduced the ban on cash deposits in order to crackdown on money laundering and track cash more closely.

Customers of Nationwide have been subject to the ban on third-party credits since 12 March 2018, while Santander closed this option just last month.

A Santander spokesperson told Which? Money: ‘From 2 April 2018, to address a risk of money laundering, we stopped receiving cash deposits into personal banking and savings accounts unless the person making the cash deposit is named on the account.’

Impact of the ban on third-party credits

Nationwide and Santander both say they advertised the changes to their policies in branches so that customers had advance notice.

However, some customers have taken to Twitter to vent their frustration at the change.

@AskNationwide discussed how my partner was spoken to at your Colchester branch… When did it become an issue for someone to pay money into an account if it’s not their account

— Amy (@amwest1987) April 16, 2018

The new rules mean grandparents are being turned away from paying cash into children’s savings accounts, including Junior Isas.

One Nationwide customer tweeted her frustration last week:

Please explain how customers and society are protected by not allowing grandparents to pay cash into children’s accounts?

— R Mel (@romfordroy) May 3, 2018

We’ve also seen reports that renters who normally pay cash into their landlord’s account have been turned away.

What to do if you need to deposit cash

Nationwide says third-party credits won’t be accepted unless it’s an emergency.

Existing Nationwide members can pay money into their own account and transfer this to another, which can be done in branch or online.

If you don’t bank with Nationwide, you will be able to make a transfer from your bank’s branch or through online banking.

The building society says that third parties can continue to pay in cheques.

Santander says if a customer who is not named on the account asks to pay money into that account, staff will discuss alternative ways of completing the transaction.

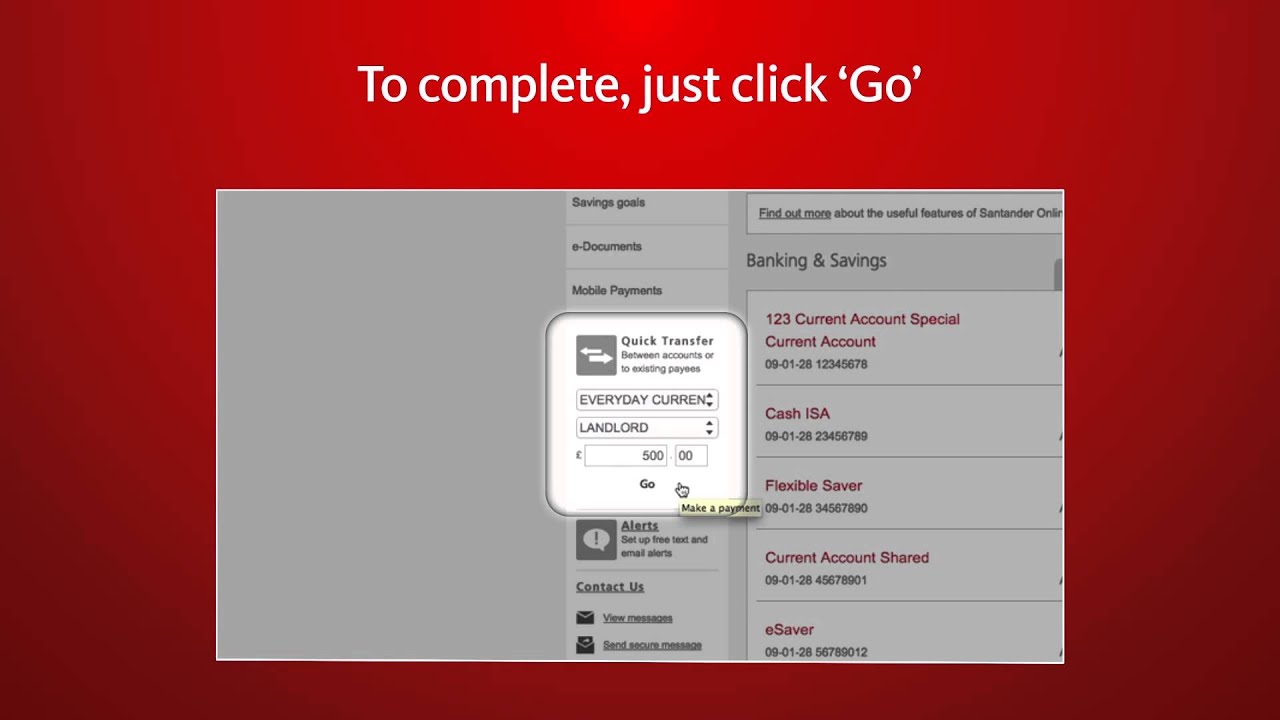

The bank said other methods of paying into an account include a cheque, regular standing order or a one-off transfer.

Santander Cheque Deposit Uk Casino

Third-party cash-deposit rules on the high street

Deposit Cheque In Atm

Which? contacted other major banks with a high street presence to check their rules on cash deposits from third parties.

Barclays has also changed the way third parties can deposit cash. Non-customers will need a printed paying-in slip from the recipient’s account. Those that don’t have the printed slip will need to find an alternative method of paying the money to the desired account like making a bank transfer.

Tesco Bank, which allows customers to pay in cash at selected stores, told Which? Money: ‘Our Instant Access Savings Account and Current Account allow electronic payments from third parties, but not cash payments.’

Santander Electronic Cheque Deposit Uk

Royal Bank of Scotland (RBS), NatWest, HSBC and TSB told us that they still accept third-party credits into savings and current accounts, and had no plans to change this policy.

TSB said it carefully reviews when someone is paying money into another person’s account and examines this on a case-by-case basis to undertake due diligence. HSBC also said it had ‘robust processes in place to detect and prevent fraudulent cash deposits’.

Santander Cheque Deposit Uk Atm

Lloyds Bank, Halifax and Bank of Scotland will also accept both cash and cheque deposits from third parties as long as they are able to provide a valid sort code and account number to credit.

Metro Bank told us they had no restrictions on third parties paying into accounts, but said it would ask additional questions on the source of the cash for larger deposits.

This article has been updated to include information on Barclays