Td Bank Direct Deposit

Posted : admin On 4/13/2022

- You have lost or will lose your employment income or self employment income for at least 14 consecutive days of the four-week period for which you are applying

- You are 15 years of age or older at the time of application.

- You are a resident of Canada.

- You are not receiving nor have you applied for EI regular or sickness benefits.

- You have not quit your job voluntarily.

- You have earned a minimum of $5,000 income in Canada within the last 12 months or in the 2019 tax year from one or more of the following sources:

- Employment income

- Self-employment income

- Provincial benefit payments related to maternity or parental leave

- Federal benefit payments related to maternity or parental leave

- Eligibility periods are fixed in four-week periods

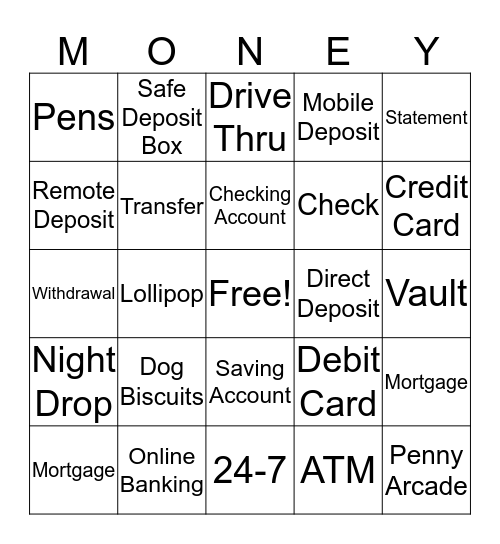

- Direct deposits are a secure and simple way to have funds directly deposited into your TD bank account. Set up direct deposit on EasyWeb on your desktop device today.

- 2 TD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account and using a supported, internet-enabled iOS or Android device with a camera.

Eligibility requirements mentioned above could be changed. Visit the CRA's CERB page to learn more and stay current with the eligibility requirements.

Note: If you are later deemed ineligible, you will be expected to repay the benefit.

Td Bank Direct Deposit

What Banks Count As Direct Deposits. Disclaimer: We make no promise the information below is 100% correct since banks can change what count as direct deposit often. If a bank/financial institution’s name is listed, that means using ACH through them was reported as successful.

With Direct Deposit, you don't have to wait for your check to clear. Funds are available when your salary, pension or Social Security payments are put directly into your designated checking or savings account.

To set up Direct Deposit you need your bank name, account number, routing transit number and type of account. We've made it simple: just complete the Direct Deposit Authorization form (PDF) and give it to your employer's payroll representative.

The Treasury Department requires all federal benefit check recipients to select an electronic payment option. Setting up Direct Deposit of your Social Security, Supplemental Security Income (SSI), Veteran Affairs (VA) compensation and pension payments is fast, easy and free.

You can set up your Direct Deposit by visiting your local TD Bank, going online at the U.S. Treasury Department's Go Direct ® website† or calling the U.S. Treasury Electronic Payment Solution Center at 800-333-1795.

Td Bank Direct Deposit Address

Have the following information ready when you sign up: Social Security or claim number, 12-digit federal benefit check number (located in the upper right-hand corner of your federal benefit check), federal benefit check amount, TD Bank account number and routing transit number.

Td Bank Direct Deposit Information

At TD Bank, there's always someone to talk to about your account. Call us or come in today.